As the second round of stimulus money is distributed, the IRS has issued a warning that people need to be vigilant about scams targeting recipients of the funds. In the worst case, failure to properly report your virtual currency transactions may lead to fines of up to $250,000 and prison. By now, you may know that if you sold your cryptocurrency and had a.

Thread Rating:

Administrator

Bitcoin is really just another form of gambling. Hardly anyone uses bitcoin to buy things,

It is, actually quite a handy currency for doing business with online casinos. No need to give some shady casino your credit/debit card or bank info and no need to trust them with paypal.

Bitpay Irs Reporting

1. $5k to my bank account.

2. $5k to my car dealership to pay for repairs.

3. $5k to BillyRyan's coinbase account to buy a comic book.

4. $5k in cash to friend who has no crypto account.

5. $5k to the IRS to pay my tax bill.

What charges/fees/transaction costs will each of the examples cost? Can I actually accomplish all 5?

I have been hearing that from the beginning, and yet, here we are. Why don't you think it will end well? When do you think the end will come? 2 years, 5 years, 100 years? Anyone can say, I don't think x stock/company will end well and never be wrong no matter how well something does in the meantime, with a chance to be right.

Back in 98/00 who would have guessed AOL would have went down the tubs so fast? I had a feeling them buying Time Warner was bad news.

Amazon... really? I didn't get it, I thought they were just going to sell books online.

As I said, it is my gut feeling. I have no evidence or expertise to support it. Just my feelings.

Hi Bill,

Would you mind identifying the exchange that had low charges? With Bid/Offer spread on the exchange rate, I usually expect it to cost a few percent.

I know nothing about these things. Guy wanted to buy a book using bitcoin and I said no. He said if he had to go through Paypal I would receive X -3%, but with bitcoin I'd get x-less than 1%. About two days after we started the process, the money was in my account and I still had the book so there was zero risk on my side.

As I said, it is my gut feeling. I have no evidence or expertise to support it. Just my feelings.

A man jumps off the Empire State building.

A man jumps off the Empire State building. As he passes the 90th floor, his phone rings.

As he passes the 80th floor, he answers it

How is it going, asks a voice as he passes the 50th floor.

The man looks around, and as he passes the 30th floor

he replies- So far ,so good.

Ok guys... Let's say I have the equivalent of $100k of Bitcoin in my coinbase account. I want to transfer ....

1. $5k to my bank account.

2. $5k to my car dealership to pay for repairs.

3. $5k to BillyRyan's coinbase account to buy a comic book.

4. $5k in cash to friend who has no crypto account.

5. $5k to the IRS to pay my tax bill.

What charges/fees/transaction costs will each of the examples cost? Can I actually accomplish all 5?

Your car dealer just needs to give you their public key. Billy the same.

The rest you need to sell on the exchange to turn into cash then do an ACH transfer.

It is, actually quite a handy currency for doing business with online casinos. No need to give some shady casino your credit/debit card or bank info and no need to trust them with paypal.

Yes I agree it is ideal for online casinos. Still that is a small number of people who actually spend bitcoin. Most hold to try and see profit later.

Your car dealer just needs to give you their public key. Billy the same.

The rest you need to sell on the exchange to turn into cash then do an ACH transfer.

So what is skimmed off in 1-5?

I guess I have to learn what a BitPay crypto credit card is and hope Apple & Google don't deplatform it.

You can use your BitPay Mastercard at almost any online or brick and mortar merchant that accepts Mastercard prepaid cards. However, the BitPay Card cannot be used in nations sanctioned by OFAC, the US Office of Foreign Asset Control. - Nov 18, 2020

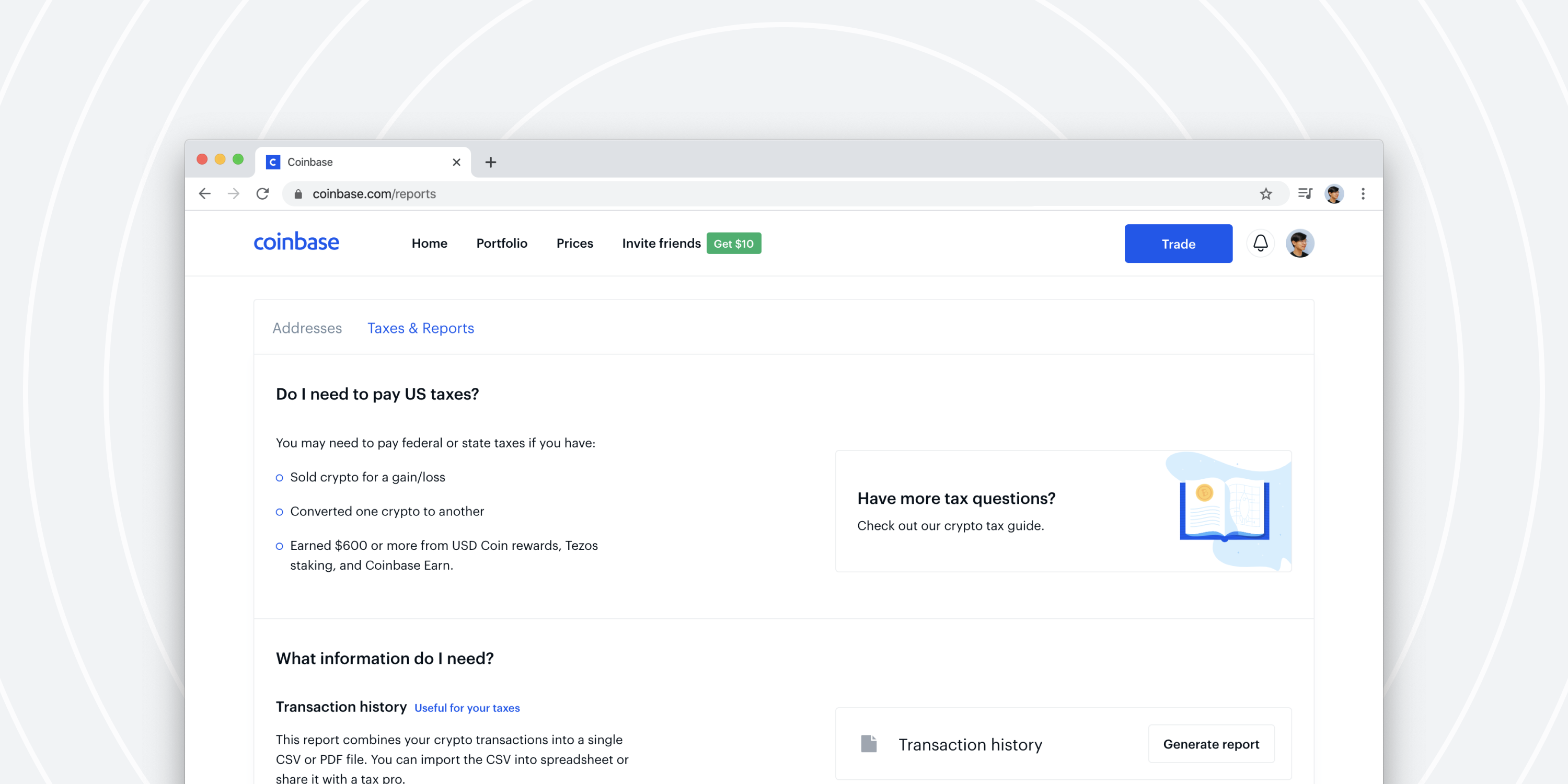

Does BitPay card report to IRS?

That means you don't have to do any extra for tax reporting for your everyday usage of the BitPay Card. But when you load the BitPay Card with dollars using Bitcoin or Bitcoin Cash, you are making a transaction which the IRS considers to be taxable under its digital currency tax guidance. - Apr 5, 2018

Does BitPay card still work?

This program termination means that all BitPay prepaid Visa cards will expire and stop working on December 31, 2020, regardless of the expiration date printed on your card. - Jan 1, 2021

Important Changes to the BitPay Prepaid Visa Card https://support.bitpay.com/hc/en-us/articles/360042021051-Important-Changes-to-the-BitPay-Prepaid-Visa-Card

Sooo, Visa out/Mastercard in.

ATM Withdrawal $2,000 per withdrawal, 3 withdrawals per day

Load Limits $10,000 per day

Spending Limits $10,000 per day

Maximum Balance $25,000 including cash loads

Soooo, can't buy a new car worth more than $10K on this card.

BitPay Exchange Rates https://bitpay.com/exchange-rates/

So what is skimmed off in 1-5?

There is always a miner free. After all, we are not communists.

Does Bitpay Card Report To Irs

A partnership between BitPay and Libra Tax aims to make life easier for thousands of bitcoin-accepting merchants who are working with BitPay.

BitPay and Libra Tax announced their new partnership yesterday, March 24th, in a joint press release. The new deal will allow all merchants processing payments with BitPay to pay their taxes with the help of Libra Tax. Bryan Krohn, the CFO of BitPay, commented:

Indeed, in addition to Libra Tax for individual clients, the company has recently launched more advanced services, Libra Business and Libra Pro, the latter being designed for accounting and audit firms with bitcoin clients. According to Jake Benson, the CEO of Libra Tax,

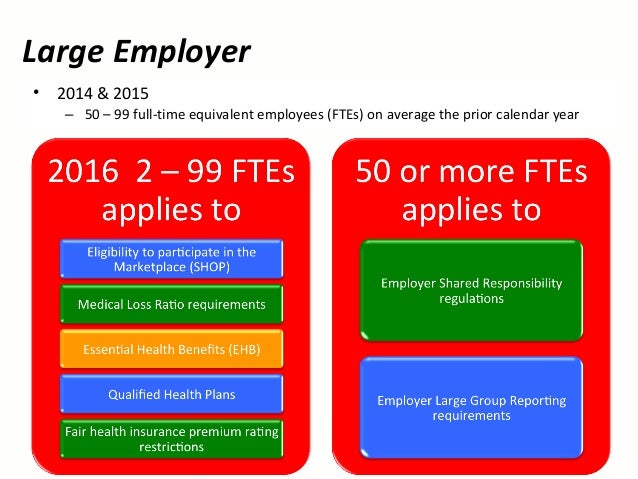

The Internal Revenue Service of the U.S. Treasury Department released a ruling on cryptocurrencies exactly a year ago, on March 25th, 2014. Under that ruling, virtual currencies are treated as capital assets and every single use of them must be taken into account when filling out a tax declaration. The task is made even tougher by the changing price of cryptocurrencies. And, according to Krohn, “where a casual user could have dozens, if not hundreds, of taxable events to report in a given year, imagine how many events a business accepting bitcoin would have”.

The companies hope that this partnership will encourage “wider public adoption of the platform by simplifying the process of Bitcoin accounting”.

Bitpay Irs Reporting Form

Currently, according to the BitPay website, the company is working with 50,000 merchants worldwide.

Libra Tax is not the only bitcoin company offering to help bitcoiners with paying their taxes. Coyno, a Berlin-based startup, has recently launched a bitcoin bookkeeping application capable of generating tax reports. Circle, an American wallet provider, offered help with tax reports to its clients.